Twenty-five years of investing in 5 minutes

By Klevin Joseph, Founder of OPMX

"There is no mystery whatsoever – only an inability to perceive the obvious."

- Wei Wu Wei

“When I was a child, I spoke like a child, I thought like a child, I reasoned like a child; when I became a man, I gave up childish ways. I am now a serious business investor.”

-Saint Paul, 1 Corinthians 13:11

Although my last name is Joseph, I now identify more with another Bible character: Saint-Paul. You have probably come across his work because he wrote what became the most common reading in Christian wedding ceremonies (1 Corinthians 13). The last line of this letter is: “Faith, hope, love. Abide by all three. But the greatest of these is love.”

But Saint Paul was a more complex character than lovey-dovey all the time Jesus or Joseph. He actually started his career by violently persecuting Christians. He was an agent for the Roman Empire, back when Christianity was considered a disruptive, Uber-like startup religion. But one day, he was on the road from Jerusalem to Damascus to arrest some Christians, when resurrected Jesus Himself appeared to talk sense to him. From that point on, Paul converted from his Jewish roots to promoting Christ.

His experience being on the other “side” and his empathy towards them made him an able evangelist. He is believed to be the source of much of the New Testament. Paul is the indispensable builder of Christianity - he laid the foundation for the Church as we know it today. Paul conducted much of his ministry by writing letters to faraway budding Christian communities. As you may know, writing epistles is also my preferred way of communicating. This one is about the story of my evolution as an investor.

When I was around 16 years old, my father handed me a Time magazine with George Soros on the cover. I was fascinated by how Soros made and gave away billions. I immediately decided I would also like to make and give away billions by trading the markets. By the time I was 24 years old, I had already been trading stocks for 5 years, completed the three levels of the Chartered Financial Analyst program, gotten a degree in Finance at McGill University and been working for one of the top performing hedge funds in Canada. I had built my first $100k in savings. I had analyzed dozens of stocks, met leading CEOs and some of the leading money managers in Canada. Through relentless lobbying, I had even convinced my boss to let me pick stocks for part of his fund. Despite my credentials on paper, in retrospect, I realize I did not know the first thing about the principles of sound investing. It would take me a further 15 years to understand the counter-intuitive, highly elusive nature of intelligent investing. This is the story of my arduous journey to see the truth from the smoke and mirrors.

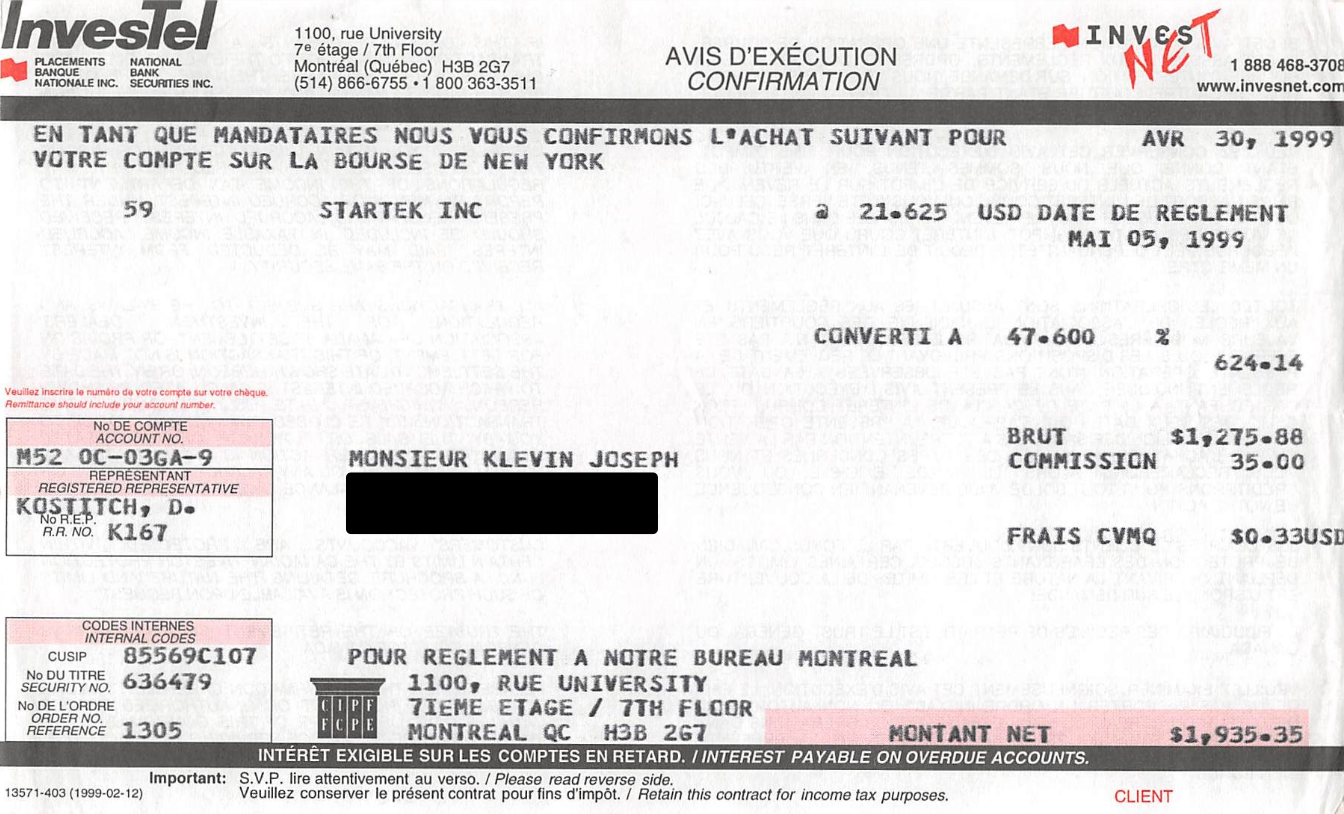

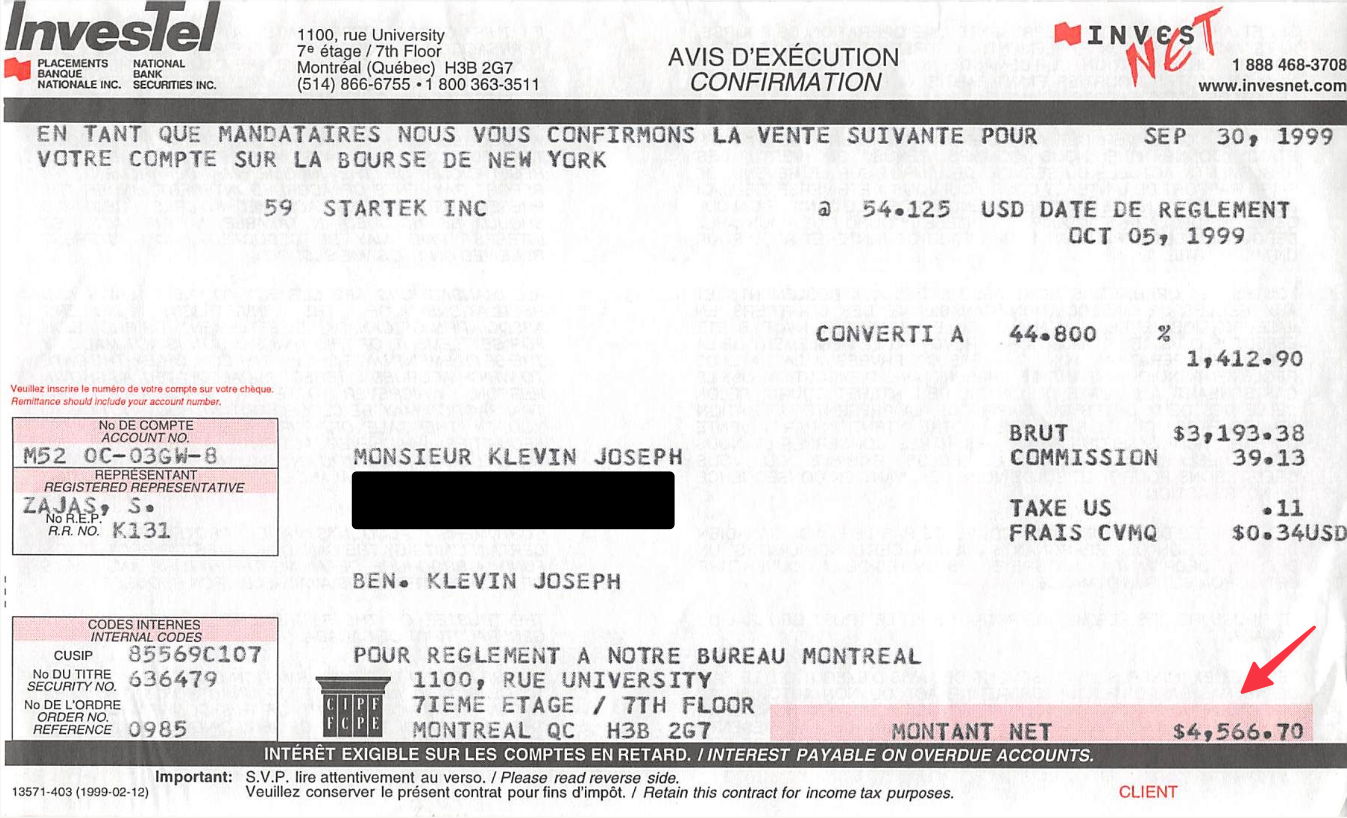

Although I may use derisive terms to make fun of unserious investors - hurtful terms such as “bed-wetters” - I actually have great empathy for anyone who is on the wrong path. For many years, I myself was a stock market bed-wetter. Stocks have been around for more than a century, but investors tend to overweight their own personal experience. My formative experience was taking $4,000 of my student loan money and investing it in one or two stocks at a time. (I didn’t need the money immediately, as I was on scholarship.)

This was during the climaxing phase of the dotcom bubble. Within a few months, my account was worth $18,000 at the peak. And then, within a few weeks, my account melted down back to around $6k when I took a pause from trading. I decided from that point on that the stock market was cruel and could take away “my money” at a moment’s notice. And so I had to be much quicker to bail out of stocks. This was the beginning of my “stop loss” mentality, which I would keep for another 15 years. Jumping in and out of trends with a momentum approach balanced by a “stop loss” rule was very common thinking in that era. It was the essence of the hedge fund trading approach. George Soros starts with the premise that nothing is knowable, and therefore you have to be flexible and go with the flow.

Armed with this “insight”, I started trading again in 2002. In 2003, I took advantage of the very strong market recovery and built my account to over $100k. In 2004, I was working as an analyst at a hedge fund in Toronto, but I got bored, especially as I was making more money from my trading than my salary. And so I came back home in Montreal to trade for myself. In 2006, I launched a formal vehicle for my trading, called The Silver Bullet Fund. This eventually become a fund for outside money, first in the US and then in Canada. For the first 45 months of the fund, it compounded at over 40%. This included being up 26% in 2008, when the world experienced a financial meltdown. This was achieved by “shorting” stocks, ie betting that they would fall. And then in 2009, I caught the new bull market and I was up about 54%. How is this possible? Simple trend following, mostly. Riding up trends and panicking early when stocks are wobbly. This was the triumph of the momentum approach. Sadly, such early success, almost entirely due to luck, would only delay my becoming a serious investor.

As the expression goes, “generals fight the last war”. So do traders. Having been one of the few people to come out of the crisis with more money, I felt I had truly absorbed the lessons of my first trauma, the dotcom crash of 2000. However, for many years after 2009, I was overly bearish - I would see a crisis at every turn. By 2013, after 3 years of stagnant performance, I closed the fund for external investors. But with my own money, I kept experimenting with trading strategies. I had another good year in 2015, but by 2016 at the 10th year anniversary of my fund, I knew I had to move on. My overly cautious strategy of dancing in and out of the market was just not suited for the roaring bull market.

Fortunately, from the very beginning, I had always been a close student of business investing and followed Warren Buffett especially closely. But I always thought that as a non-billionaire, I could not afford to see my savings gyrate wildly from year-to-year. Further, I don’t think someone with my inclination for problem-solving could ever accept the seemingly simplistic solutions of Buffett. I believe my experimentation was necessary. Though I succeeded in never having a serious drawdown with The Silver Bullet Fund, that merely meant I found another way of failing. If assets prices are soaring while you are too timid to be in the markets, you are effectively becoming poorer. Wealth is relative. An experimental phase in investing is fairly common. Even Buffett has talked about his “misspent youth”, between the ages of 11 and 21, when he tried things like technical analysis. He described eventually reading Ben Graham’s book as a “road to Damascus” moment. From 2016 onwards, I have been an advocate for serious business investing. The “serious” solution to dealing with volatility is simply to hold some bonds.

Even the very best traders, who have decades long track records seem to eventually fizzle out. My initial hero George Soros, in his latter years, was a Chicken Little who saw a crisis at every turn. Of course, by then he was a billionaire many times over, so underperforming the markets was hardly a concern. Today, even if I had some sort of God-given ability to trade, I would still opt to be a serious business investor. That’s because traders rarely get to build something that lasts, let alone build something that can outlast them. Having thought of investing, managing money and building a fortune since I was a teenager, I have absolute conviction about this:

It’s better to own compounding machines than to try to be a compounding machine.

As an advisor, I can monetize everything I have learned over a large base of clients. But for most people, this old adage applies: If you don't know who you are, the stock market is an expensive place to find out. The sooner you become a serious investor or delegate your wealth management to one or more serious investors, the better off you will be.